Nduom Urges BoG: Return Our License and Assets1 min read

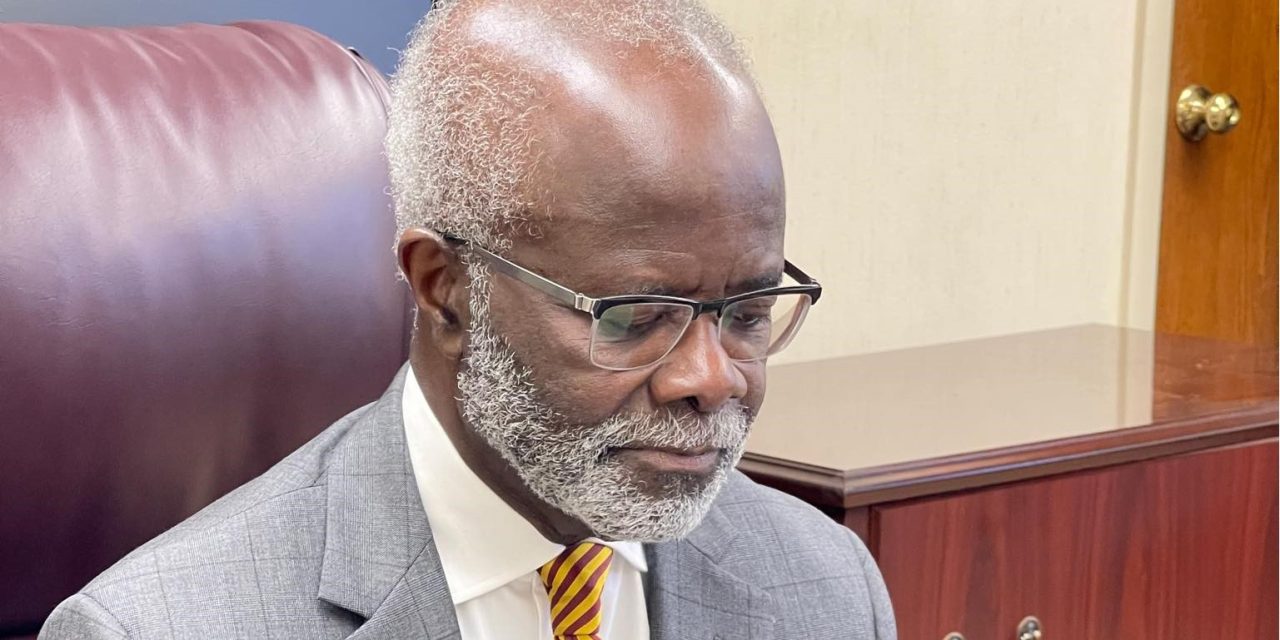

Dr. Kwesi Nduom, the proprietor of the now-defunct GN Bank, passionately appeals to Dr. Ernest Addison, Governor of the Bank of Ghana (BoG), to reconsider recent developments and restore both the banking license and seized assets of GN Bank, which were revoked following financial insolvency issues.

In his plea, Dr. Nduom emphasizes the readiness of GN Bank to resume operations, highlighting the continued viability of its assets if the banking license is reinstated.

The Bank of Ghana’s decision to revoke GN Bank’s license in 2019 was part of broader measures aimed at consolidating the banking sector, citing significant breaches in regulatory compliance. These breaches included shortcomings in capital adequacy, liquidity, and governance, as detailed in a statement issued by the Central Bank in August 2019.

Dr. Nduom recently disputed the BoG’s claims regarding insufficient capital adequacy, pointing to evidence from the GN Savings and Loans transition report which he believes supports the bank’s solvency.

In a Facebook post on June 23, Dr. Nduom urged Governor Addison to reconsider these new facts and facilitate the return of GN Bank’s license and assets to operational status. He expressed a firm commitment to reviving the bank, potentially re-establishing it as a universal bank, and thereby contributing significantly to employment and financial inclusion.

Dr. Nduom lamented the neglect of GN Bank’s assets, including numerous branch buildings, which he claims were left to deteriorate after the BoG’s appointed receiver took control.

He concluded by underscoring GN Bank’s preparedness to comply with savings and loans requirements, citing the availability of resources that could be mobilized to meet regulatory thresholds.

The plea signals Dr. Nduom’s ongoing efforts to restore GN Bank’s role in Ghana’s financial landscape, emphasizing its potential to reinvigorate economic activity and employment opportunities across its extensive branch network.