Debt Exchange: We’ve Been Very Mindful Of Potential Impact On Pension Funds Of Workers – Akufo-Addo4 min read

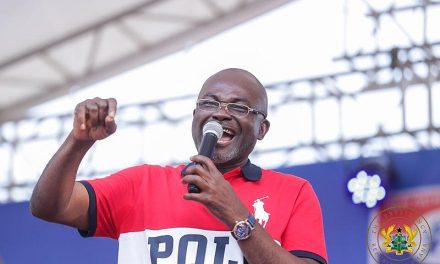

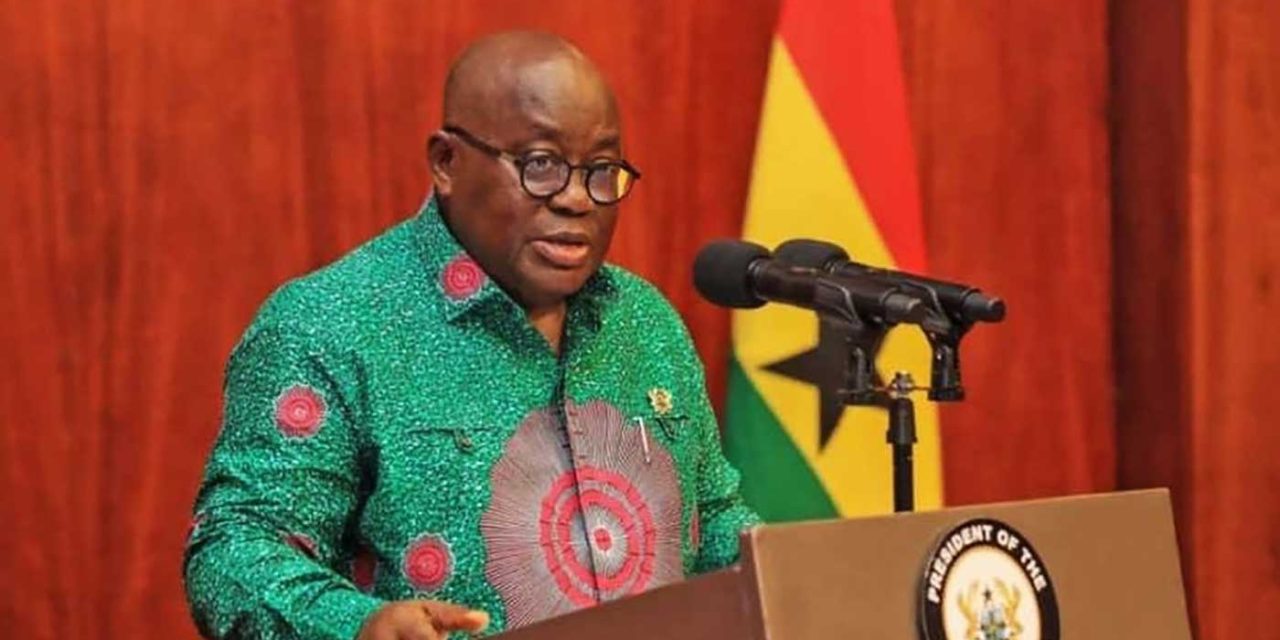

President Nana Addo Dankwa Akufo-Addo

He emphasized that participation in the Domestic Debt Exchange Programme, “voluntary as it was, was critical for the protection of the economy, and the enhancement of our capacity to service our public debts effectively and create fiscal space for our growth and development. In the midst of the current economic crisis, we cannot risk defaulting in the payment of our public debts, which would attract severe consequences – hence the debt exchange programme.”

He stated that despite the back and forth which characterised discussions with stakeholders on the Domestic Debt Exchange Programme, Government is truly grateful for the overwhelming participation of bond holders.

The support, cooperation, input and feedback Government received to finetune eventually the Domestic Debt Exchange Programme were unprecedented and reassuring, he said.

Speaking during the May Day celebration in Bolgatanga on Monday May 1 organized by the Trades Union Congress (TUC) , Mr Akufo-Addo said in undertaking the Domestic Debt Exchange Programme, “we have been very mindful of its potential impact on pension funds of workers. We will not act in any way to short-change workers in protecting their pensions.

“It is for this reason that Government, through an MOU signed with Organised Labour on 22nd December 2022, decided to grant exemption to all pension funds in the Domestic Debt Exchange Programme. At the same time, in the MOU, both Government and Organised Labour agreed to work together ‘to explore mutually beneficial options within debt sustainability limits and to also promote macroeconomic stability and economic recovery in the spirit of social partnership’. “

“In this regard, within global risk management practice, the options should include diversifying the portfolio of pension funds from the current seventy percent (70%) in government paper to real sector investments including rail, housing, urban transportation, motorways and airport as is done by other pension funds. I am aware that both the Minister for Finance and the Minister for Employment and Labour Relations and their technical teams have been working with Organised Labour/Associations and Pension Fund Managers/Trustees to explore these mutually beneficial options. I would like to use this occasion to appeal to Organised Labour to work urgently with Government to conclude the discussions within the spirit of social partnership and burden-sharing towards addressing our economic challenges, and providing a stronger base for our rapid growth and development,” he said.

He added that “We are also very much aware of the impact of the Domestic Debt Exchange Programme on the domestic financial sector, and steps are being taken to mitigate the impact of the Domestic Debt Exchange Programme on the sector.”

As has been announced by the Finance Minister, he said, “we are establishing the Ghana Financial Stability Fund (GFSF) to provide, amongst others, solvency and liquidity support to eligible financial sector institutions, which may be affected by the Domestic Debt Exchange Programme.

“In addition, the Bank of Ghana and the regulators in the financial sector space have provided some regulatory reliefs to support affected institutions. In keeping with our common objective, Government, through the Financial Stability Council, will monitor continuously the impact of the Domestic Debt Exchange Programme on financial institutions to enable it take remedial action, if and when necessary. This would ensure that measures put in place to safeguard incomes, deposits, pensions, investor funds and assets are effective.

“Mr. Secretary General, I agree with Organised Labour when it says “Protecting Incomes and Pensions in an Era of Economic Crisis is Our Responsibility”. This is evidenced by the fact that, over the course of the year, Government has kept every single public sector worker on the payroll. There have been no job losses. Every public sector worker continues to keep his or her job. Even at the peak of the dual global health and economic crisis of the last three (3) years, Government ensured that no public sector worker was taken off the payroll as a result of the crisis. Government’s posture, today, is the same, even in the difficult times we find ourselves.

“We have demonstrated this through our commitment to increases in the national daily minimum wage, base pay, and pension payments, amongst others, in spite of their fiscal impact on the economy. Indeed, these increments have been made possible because Government is very empathetic towards the people, as it should be, and is very much concerned about their plight and the future of our country. In so saying, I am aware the Ministries for Finance and Employment and Labour Relations are working on the payment to the retirees of 2020. SSNIT has competed the computation, and has forwarded it to the Minister for Finance, who has assured me that it will be effected this year.”